Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Does Your Driving Record Affect Your Credit Score?

July 1, 2025

Quick Answers

Your driving record does not directly influence your credit score, as traffic violations and points are not reported to the three major credit bureaus.

However, unpaid traffic tickets or court fines can be sent to a collections agency, which will report the debt and negatively impact your credit history.

Similarly, a poor driving history can increase your auto insurance premiums, and if those higher bills go unpaid, the resulting collections account will damage your credit score.

What is my driving record?

Your driving record, often called a Motor Vehicle Report (MVR), is the official history of you as a licensed driver. It contains details about traffic violations, accidents, license suspensions or revocations, and any driving-related convictions. This information is compiled and maintained by your state's Department of Motor Vehicles (DMV) or an equivalent agency.

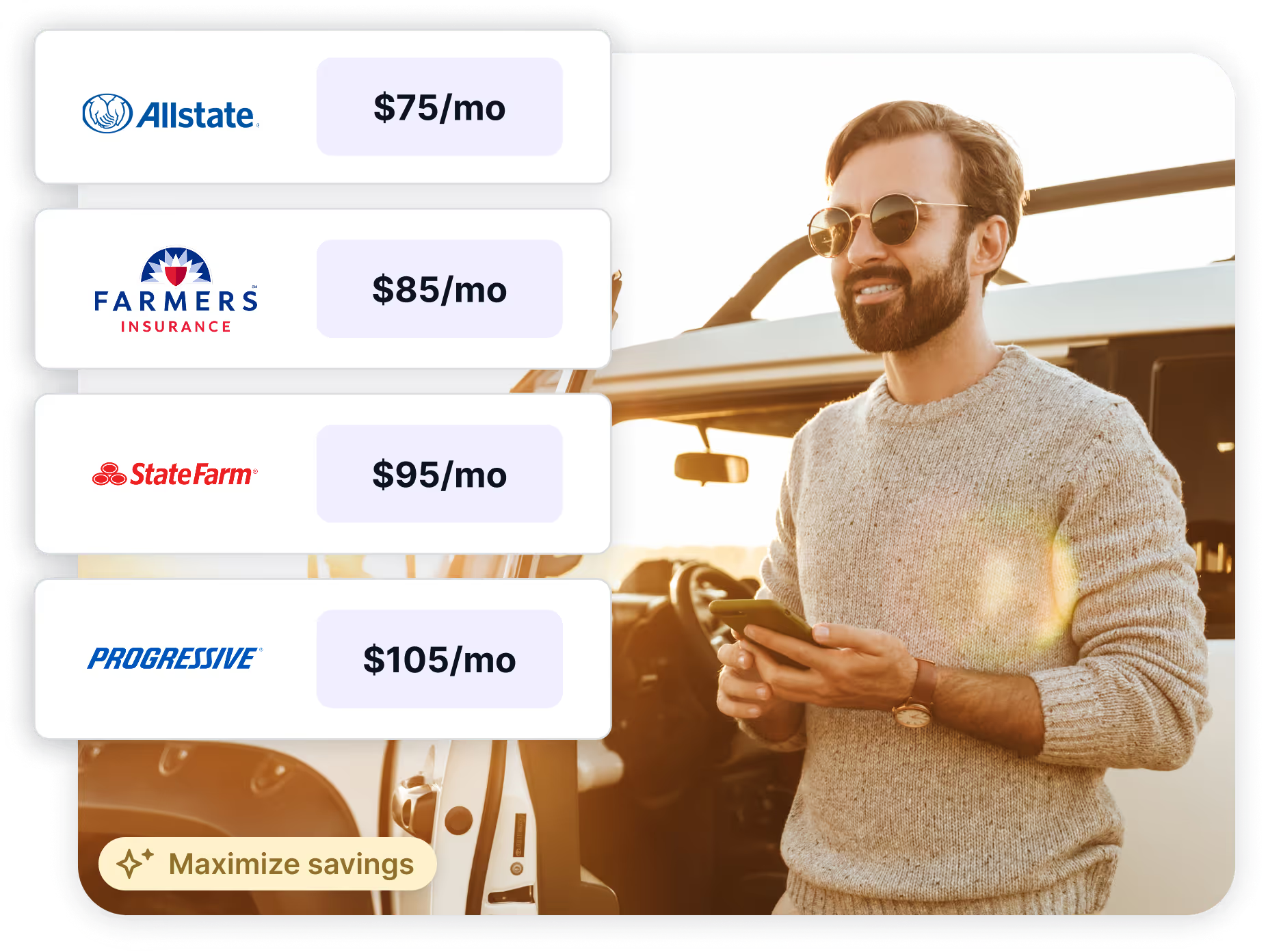

While your driving record and credit score are distinct reports, they can be interconnected through your insurance. A history of violations can lead to higher insurance premiums, and if these bills or related traffic fines go unpaid, they may be sent to collections, which can lower your credit score. Additionally, many insurance companies use a credit-based insurance score, derived from your credit report, to help set your premium rates.

How Your Driving Record Can Impact Your Credit Score

While your driving history itself isn't on your credit report, unpaid traffic fines or court fees can be. If these debts go to collections, they can significantly harm your score.

- An infraction occurs. It starts with a moving violation, like a speeding ticket, or an at-fault accident that results in court-ordered fines. This creates a new financial obligation.

- The debt goes unpaid. If you fail to pay the ticket or associated costs by the due date, the amount becomes a delinquent debt owed to the municipality or court system.

- The account is sent to collections. After a period of non-payment, the government entity will often turn the debt over to a third-party collection agency to pursue payment.

- The collection is reported. The collection agency then reports this unpaid debt to one or more of the major credit bureaus, where it appears as a new collections account on your credit report.

- Your credit score drops. This new collections account is a significant negative event that will almost certainly lower your credit score, making it harder to get approved for future credit.

How Much Will Your Driving Record Affect Your Credit Score?

While your driving record doesn't directly influence your credit score, certain related financial activities can have a significant indirect impact. Here are a few key areas where poor driving habits can ultimately affect your credit standing.

- Unpaid Fines. Traffic tickets and court fees that go unpaid can be sent to a collection agency. This action is reported to credit bureaus and will negatively impact your score until the debt is resolved.

- Insurance Premiums. A bad driving history typically results in higher car insurance rates. This financial strain can make it difficult to pay other bills on time, which directly harms your credit score.

- Legal Fees. Serious violations may require hiring a lawyer, creating substantial debt. If you finance these legal costs, any missed payments on that loan will be reported and can lower your credit score.

How You Can Avoid Your Driving Record Affecting Your Credit Score

Maintain a Clean Driving Record

The most effective strategy is to drive safely and obey all traffic laws. By avoiding tickets and at-fault accidents, you prevent negative entries from appearing on your record. This ensures no court fines or insurance surcharges arise that could indirectly impact your financial standing.

Settle Fines Immediately

If you receive a traffic ticket, pay the fine promptly. Unpaid fines can be sent to a collection agency, which will report the debt to credit bureaus. This creates a collection account on your credit report, directly harming your score, so timely payment is critical.

Ways to Improve Your Credit Score

Your credit score is a vital part of your financial health, but a low number isn't a life sentence. Fortunately, there are several proven methods to build a stronger credit profile through consistent, positive financial habits.

- Monitor your credit reports. Regularly check your reports from Experian, TransUnion, and Equifax to identify and dispute any inaccuracies that could be dragging down your score.

- Establish automatic bill payments. Your payment history is the single most important factor in your score, so setting up automatic payments is a simple way to ensure you never miss a due date.

- Reduce your credit utilization ratio. Aim to use less than 30% of your available credit. You can improve your ratio by paying down balances or requesting a credit limit increase.

- Become an authorized user. Being added to the credit card of a trusted person with a strong payment history can help improve your own score, as long as their account reports to all three bureaus.

- Diversify your credit mix. Lenders prefer to see that you can responsibly manage different types of debt, such as a mix of revolving credit (credit cards) and installment loans (auto or personal loans).

- Limit hard inquiries. Applying for too much new credit in a short time can temporarily lower your score. Space out your applications and use prequalification tools to shop for rates without a hard pull.

The Bottom Line

Your driving record doesn't directly affect your credit score. However, unpaid traffic fines or car insurance-related debts that go to collections can negatively impact your credit history and score.

Frequently Asked Questions

Does a speeding ticket affect my credit score?

No, a standard traffic ticket for a moving violation will not directly harm your credit score, as these infractions are not reported to credit bureaus.

Can unpaid parking tickets hurt my credit?

Yes, they can. If you fail to pay a parking ticket, the issuing municipality may send the debt to a collection agency, which will report it.

How do car insurance payments relate to my credit score?

While rates don't impact your score, missed insurance payments can. An insurer might send the overdue account to collections, which negatively affects your credit history.

Supercharge Your Credit Cards

Experience smarter spending with Kudos and unlock more from your credit cards. Earn $20.00 when you sign up for Kudos with "GET20" and make an eligible Kudos Boost purchase.

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.