Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

When To Pay Off Your Credit Card

July 1, 2025

Paying off your credit card at the wrong time could be costing you. Credit card rates are nearing record highs, and paying on your payment’s due date is generally only good if you’re paying the full statement balance. If you’re carrying a balance, you should be paying as soon as you reasonably can. Paying early can also help boost your credit score.

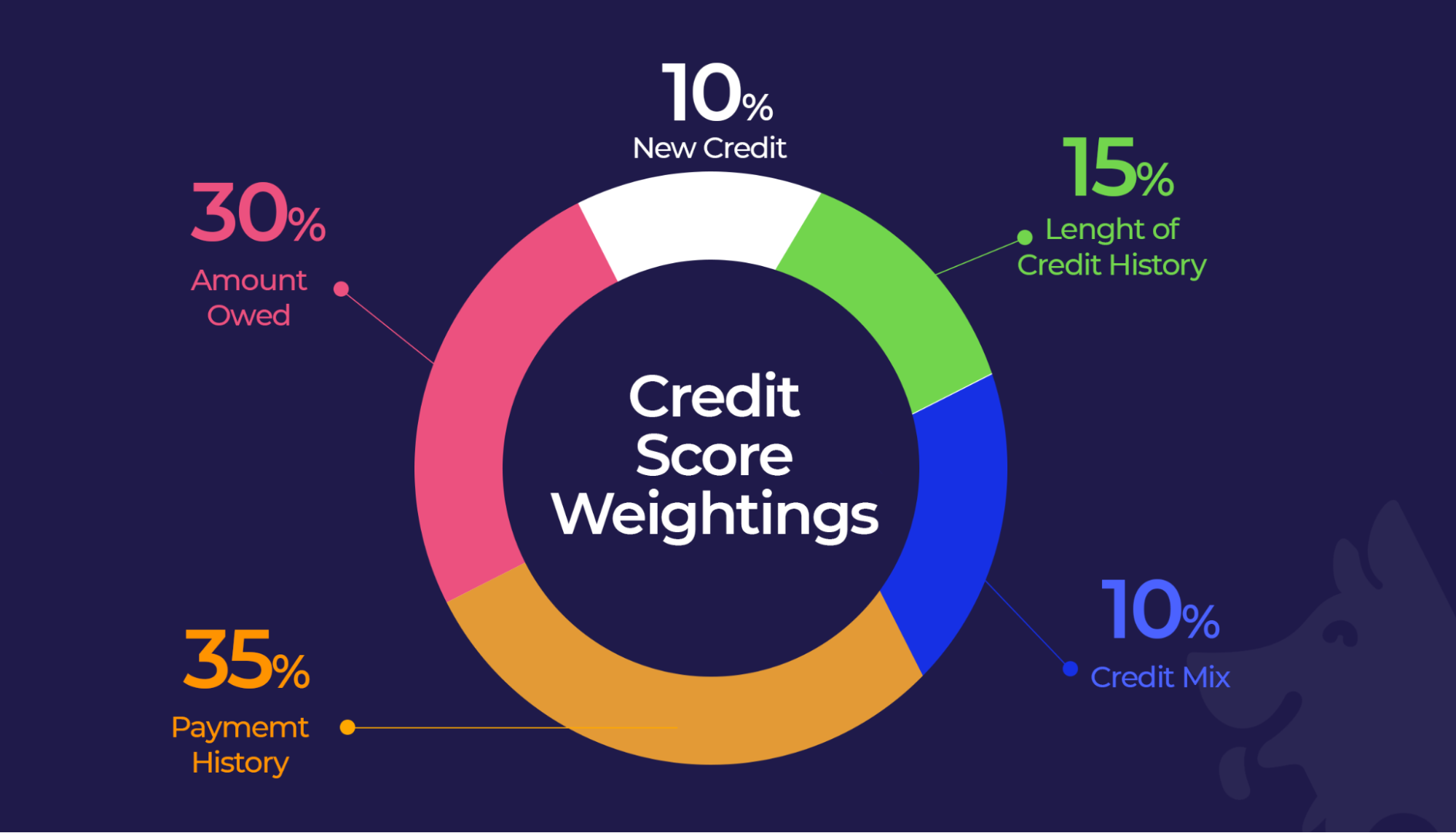

That’s because the balance that gets reported to the credit bureaus can have a direct effect on your credit scores. Two of the most important factors for your credit score are payment history and credit usage. Together, they make up 65% of your score. Paying your bill on time accounts for 35%, while how much credit you use is 30%.

Carrying a credit card balance each month is costly. Americans pay roughly $120B in interest and fees to credit card companies yearly — about $1,000 per household. But in some cases, carrying a balance can’t be helped. Whether you’re looking to save on interest charges or boost your credit score, this article will help you determine the best credit card payment schedule for you.

When Should You Pay Off Your Credit Card?

When it comes to paying off your credit cards, there are really only two options — paying early or paying on time. Paying late should never be considered an option. At the very least, you should pay the minimum on or before the due date. If you do end up paying late, expect to be hit with late fees.

The due date — the day you must make at least the minimum payment by — for your credit card payment can be found on that card’s statement. It’s also usually displayed when you log in to your mobile app or the credit issuer’s website, depending on the type of credit card you have.

Paying down your balance by that date is crucial for maintaining a healthy credit score.

Understanding Your Credit Card Statement

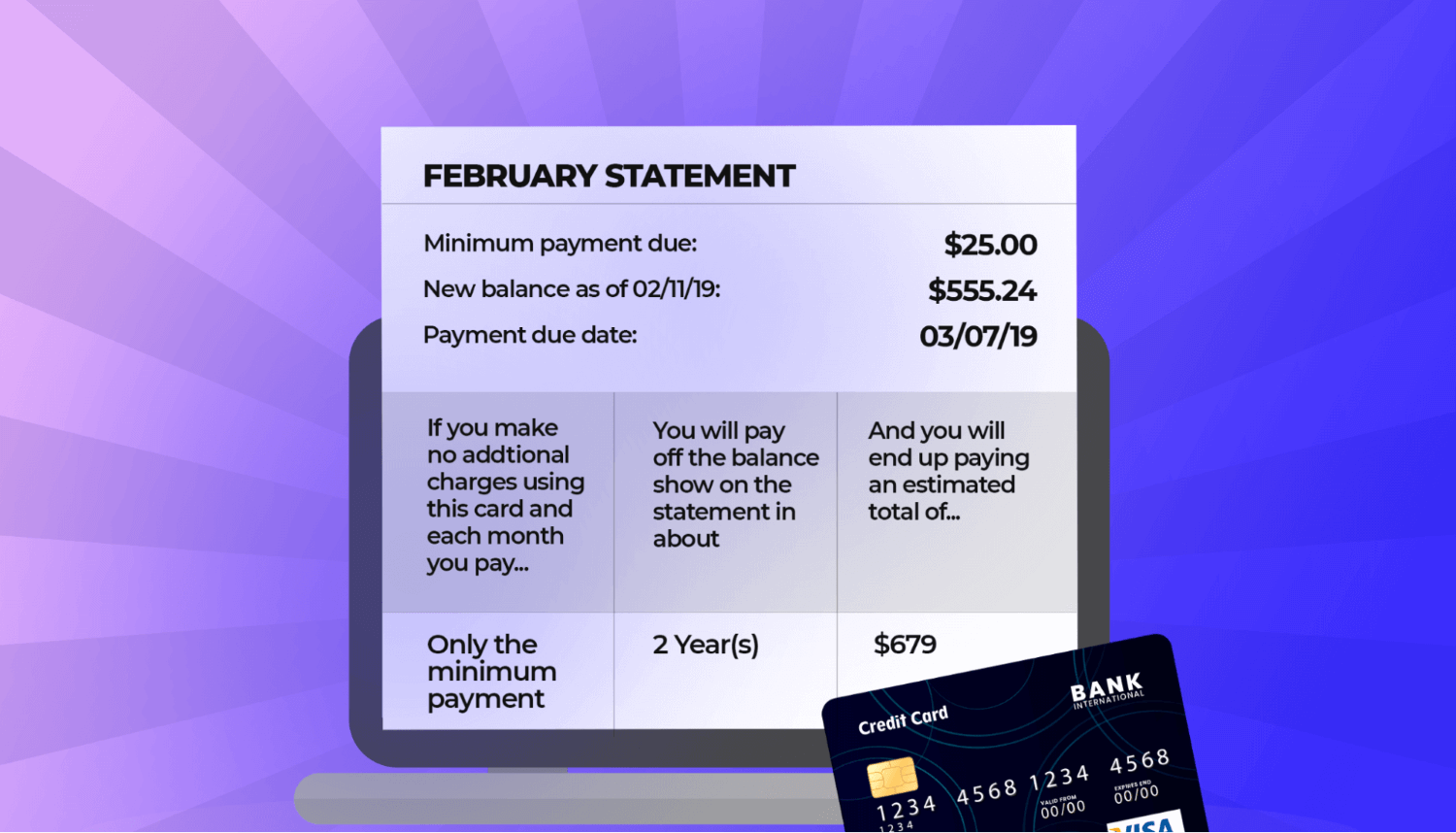

Your credit card statement will have all the key information you’ll need to pay your bill. For starters, the statement date is the date your statement is put together.

Generally, the statement date and due date are 21 to 25 days apart. This timeframe is called the grace period.

For example, the statement date for your credit card might be the 3rd of every month, while your due date is the 28th. In that case, you have a 25-day grace period to pay your statement balance before any interest is charged.

Your billing cycle ends on the statement date, and your statement balance is calculated on that day. The statement balance is also what gets reported to the credit bureaus. This balance is calculated as the balance at the start of the billing cycle, plus any new charges and minus any payments made.

The reporting date (which won’t be on your statement) is the date that the card issuer reports your balance to the credit bureaus. Note that if you have multiple cards, those cards may have different billing cycles and grace periods.

How is credit card interest calculated?

If you don’t pay your statement balance in full each month, interest occurs daily. This interest is calculated by taking an average of the balance owed by the cardholder on each day of the billing period — also known as the average daily balance. Any new charges begin to accrue interest immediately.

Many cards offer introductory periods where no interest is charged for periods of up to 18 months. (We cover some of these in our guide to the best credit cards for young adults.)

Reasons To Pay Off Your Credit Card Early

Paying your statement balance in full each month means you get a grace period. Basically, this is an interest-free loan. By paying the statement balance at the last possible moment — on the payment’s due date — you can maximize your interest-free grace period. However, there are two scenarios in which you may want to consider paying your card off early.

Credit score boost

If you pay your statement balance in full but are still concerned about your credit score — maybe you’ll be applying for a home or car loan soon — then making multiple payments a month could give your score a boost.

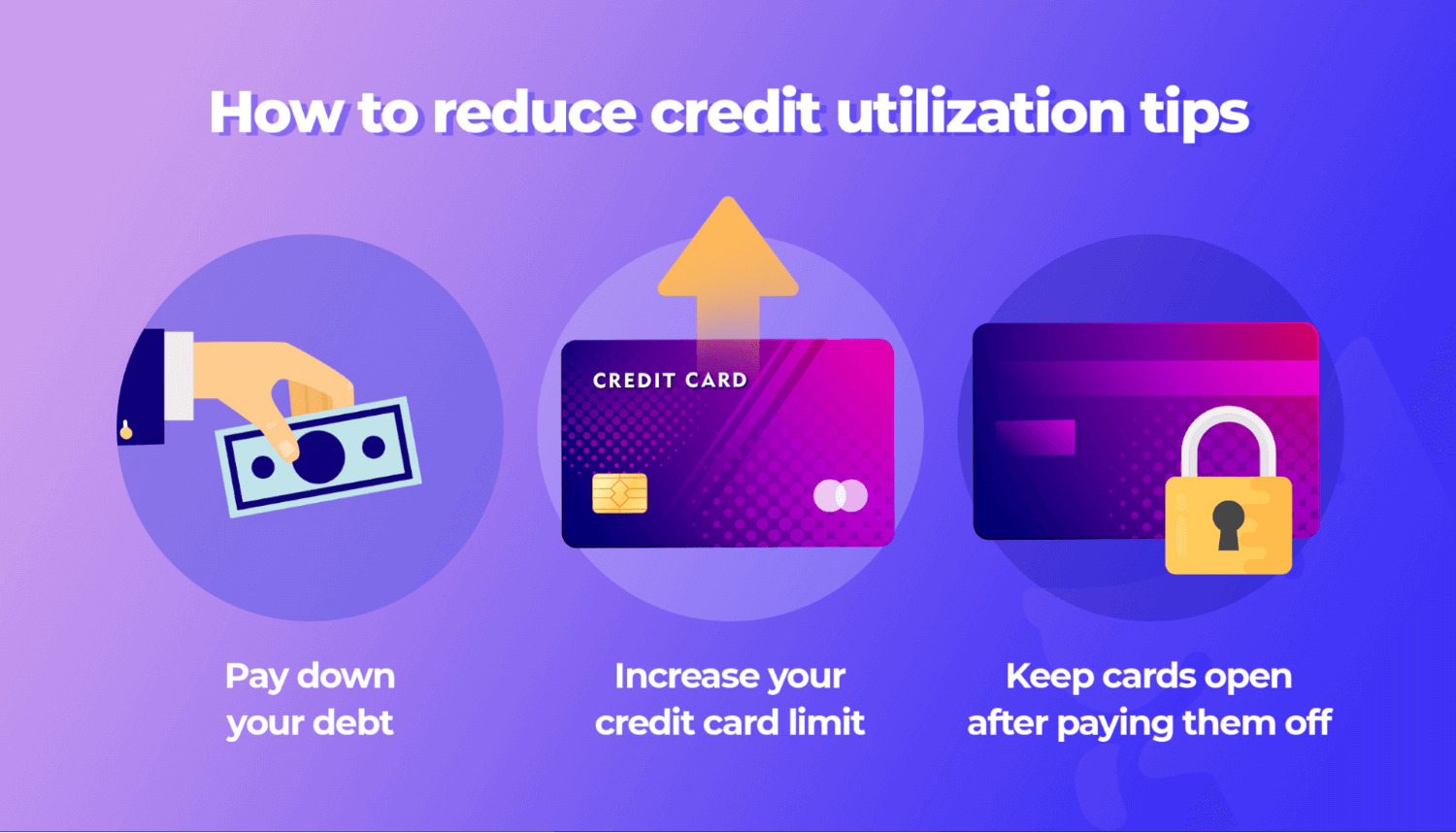

Credit usage is right behind payment timing as the key factors that impact your score. Your credit use ratio is your credit card balance divided by your credit limit and then multiplied by 100 (to get a percentage). Your credit card limit is the total amount of credit you have available on a particular card. (This varies based on the type of card; some credit cards have high limits, but have a strict application process, while a standard one starts at $2–5,000.)

For example, if you have a credit card with a $2,000 credit limit and a $500 balance on the card, your credit utilization is 25% ($2,000 / $500 × 100).

It’s suggested that you keep your credit utilization below 30% (the lower, the better). Thus, if you are interested in keeping your score as high as possible, you’ll want to pay toward the balance whenever your credit utilization approaches 30%.

Reduce interest

If you pay in full, you get an interest-free grace period of roughly three weeks. However, if you fail to pay the statement balance, you lose the grace period, and interest accrues daily until you pay the statement balance in full for two consecutive bills.

So, if you’re only paying the minimum or part of your statement balance, then you’re going to be paying interest. And given that credit card interest is calculated daily, you’re better off paying as soon as possible. That is, even if you only plan to pay the minimum payment, do so as soon as you reasonably can — don’t wait until the due date. This will help cut your interest, even just a little bit.

Paying ASAP can save you a significant amount of money on interest if you’re not able to pay the statement balance. Say you have a $10,000 statement balance on your credit card with a statement date of July 1. Your payment is due on July 25, and you make a $3,000 payment on that day. For 24 days, your balance was $10,000, and for one day, it was $7,000 — making your average daily balance $9,880. If your interest rate is 16%, then your interest charge would be $131.73. Imagine instead that you made that $3,000 payment on July 11 instead of July 25. Your average daily balance would be $8,200, and your interest charge would be only $109.33.

Credit Card Payment Tips

In addition to paying off your credit card on time, there are other strategies you can use to help you better manage your card payments.

What happens if you pay late?

If you make a credit card payment late, you’ll likely get hit with a late fee — plus a possible ding to your credit score. Generally, as long as you don’t go over 30 days late, your credit card company won’t report a late payment. However, the longer you go without paying, the more damage will be dealt to your credit score.

If you go long enough without paying the minimums — usually 180 days late — you’ll be in default, and the balance may be sent out to a collection agency.

What if you can’t pay your payment?

If you’re finding that all your bills are hitting at the same time each month — making budgeting difficult — most credit issuers will allow you to pick your own due date. This means you can move the date to earlier or later in the month or around the day you get paid.

If you find yourself struggling to pay in full each month, consider creating a budget to identify non-essential expenses and therefore help cut overspending. If you’re still falling behind, you can consider a balance transfer.

Some credit cards offer 0% interest when you open a card and transfer a balance from another card. These cards don’t charge interest for a set period, usually 12 or 18 months. During that time, you can chip away at the debt more quickly since no interest will be charged — but you’ll need to make sure that you pay the balance off before the introductory period is over.

Debt reduction strategies

The average American has four credit cards. So, if you have no choice but to carry a balance on one or more of your credit cards, there are strategies you can use to chip away at the amount owed. These include the debt avalanche and debt snowball strategies.

With the avalanche method, you focus on making the minimum payments on all your cards and using any extra funds you have to pay the debt with the highest interest rate.

Meanwhile, with the snowball method, you pay all the minimums and then use any excess money to pay toward the smallest amount of debt (the card with the smallest balance). Then, you move to the next-highest debt, gaining momentum as you go — like rolling a snowball.

The avalanche method tends to require more discipline, but it’ll save you money on interest. The key is to pick a strategy you’ll stick to.

Tips for Reducing Interest Charges

If you pay your statement balance and keep your credit usage at or below 30%, there’s little benefit to paying off a credit card before the due date. But if you’re carrying a balance each month, consider paying your bill as soon as possible — even if it’s just the minimum payment — as this will help cut your interest costs.

Roughly 40% of people who carry a card balance don’t know the interest rate on their card. Find it, and do the math. For example, the average adult in the US carries a credit card balance of $5,500. The average interest rate on credit cards is 15.7%. That works out to over $860 per year in interest. Making multiple payments a month and paying as soon as you can — even if it’s just a week early — will help reduce those charges.

If you’re paying interest on a credit card, at least you want to make the absolute most of every card you have. Kudos will automatically choose the credit card that offers the best rewards for each purchase you make online.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)