Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Apple High-Yield Savings Account Review: Is 4.25% APY Worth It in 2026?

July 1, 2025

What Is Apple's High-Yield Savings Account?

Apple's High-Yield Savings Account, launched in April 2023, offers an impressive 4.25% APY exclusively to Apple Card holders. This federally insured savings account, backed by Goldman Sachs Bank, combines competitive interest rates with seamless integration into the Apple ecosystem. With no monthly fees and no minimum balance requirements, it represents a significant opportunity for Apple users to maximize their savings potential.

Apple Savings Account Pros & Cons

Pros:

- Competitive 4.25% APY (as of 2024)

- No monthly maintenance fees

- No minimum balance requirement

- Automatic Daily Cash deposits from Apple Card purchases

- Seamless integration with Apple Wallet

- FDIC-insured up to $250,000

- User-friendly mobile interface

Cons:

- Exclusively available to Apple Card holders

- No joint accounts available

- Limited deposit options (ACH transfers only)

- Previous reports of withdrawal delays

- Uncertain future due to potential Goldman Sachs partnership end

- Maximum deposit limit of $1,000,000

Who Is the Apple Savings Account For?

The Apple High-Yield Savings Account is ideal for:

- Existing Apple Card users seeking competitive interest rates

- Tech-savvy individuals comfortable with digital banking

- People who frequently earn Daily Cash rewards

- Savers who prefer managing finances through their iPhone

- Users looking for a no-fee, high-yield savings option

Real-World Savings Example

Let's break down the earning potential with Apple's 4.25% APY:

- Initial deposit of $5,000 would earn $216 in interest after one year

- Starting with $50 and depositing $50 monthly for five years:

- Total deposits: $3,050

- Interest earned: $347.84

- Final balance: $3,397.84

Comparing Apple Savings with Other High-Yield Accounts

How Apple Savings Stacks Up:

- Average savings rate (FDIC): 0.45%

- Apple Savings: 4.25% APY

- Other online banks: 4.00-4.50% APY range

Top alternatives include:

- SoFi Checking and Savings

- Capital One 360 Performance Savings

- Ally Online Savings Account

How to Open an Apple Savings Account

- Requirements:

- Active Apple Card

- Social Security Number or Individual Taxpayer Identification Number

- U.S.-based address

- Apple Wallet app

- Setup Process:

- Open Apple Wallet app

- Select Apple Card

- Choose "Set up Savings"\

- Follow verification prompts

Managing Your Apple Savings Account

Deposit Options:

- ACH transfers from linked external accounts

- Apple Cash balance transfers

- Automatic Daily Cash rewards deposits

Account Features:

- Real-time balance tracking in Apple Wallet

- Interest earnings monitoring

- Secure encryption

- Easy fund transfers

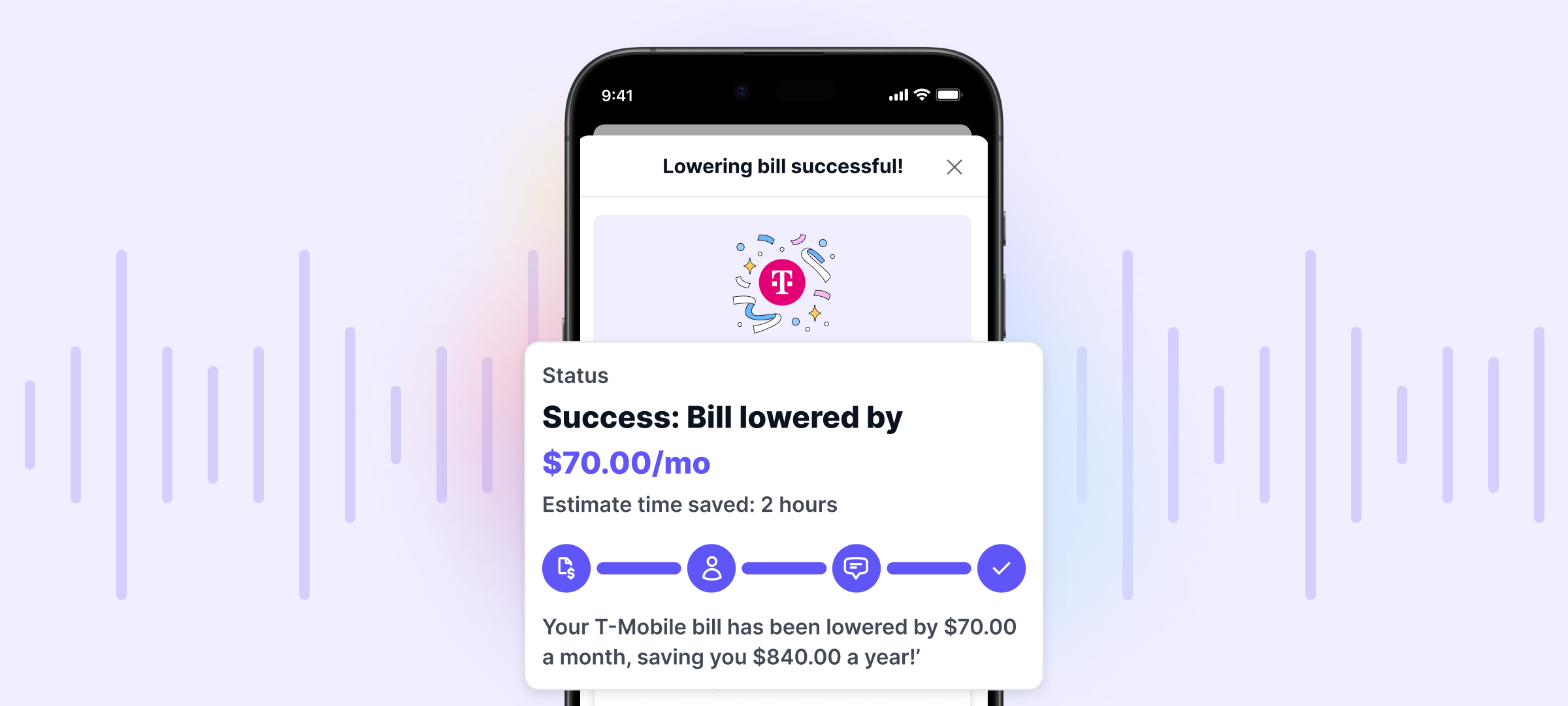

Consider Using Kudos to Maximize Your Rewards

While Apple's High-Yield Savings Account offers excellent interest rates, you can potentially earn even more by optimizing your credit card rewards with Kudos.

This free financial companion helps you:

- Automatically choose the best credit card for each purchase

- Access rewards from over 15,000 stores

- Multiply your rewards up to 5X during Flash Boost events

- Get personalized credit card recommendations

Currently, Kudos is offering $20 back after your first eligible purchase — simply sign up for free with code "GET20" and make a purchase at a Boost merchant.

Expert Takeaway

Apple's High-Yield Savings Account offers a compelling 4.25% APY with no fees or minimum balance requirements, making it an attractive option for existing Apple Card holders. While the account has some limitations, its seamless integration with the Apple ecosystem and competitive interest rate make it worth considering, especially for those already invested in Apple's financial services.

Apple Savings Account FAQ

Is Apple's Savings Account FDIC insured?

Yes, funds are FDIC-insured up to $250,000 through Goldman Sachs Bank.

Can I open a joint Apple Savings Account?

No, Apple currently only offers individual accounts.

What's the minimum deposit required?

There is no minimum deposit requirement to open or maintain the account.

How do I withdraw money from my Apple Savings Account?

You can withdraw funds through ACH transfer to a linked external bank account.

Will the Goldman Sachs partnership end affect my account?

While changes may occur in the future, your funds remain FDIC-insured and secure.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)