Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Bluedot Debit Card: Revolutionizing EV Rewards?

July 1, 2025

Introducing Bluedot

Electric cars accounted for roughly 18% of all cars sold in 2023, up from 14% in 2022 and only 2% 5 years earlier (source: IEA.org). As electric vehicles (EVs) continue to gain popularity, Bluedot has emerged as a game-changer in the industry. This innovative mobile app aims to make EV ownership more appealing and accessible by offering a comprehensive financial solution tailored to the needs of EV drivers. In this blog post, we'll explore the goal behind Bluedot and why they offer such generous rewards to their users.

What Is Bluedot?

Founded by Ferhat Babacan and Selinay Parlak in 2019 to accelerate the transition to a cleaner, more efficient transportation system, Bluedot is a banking and rewards platform for EV owners that caters to both individual owners and fleet managers.

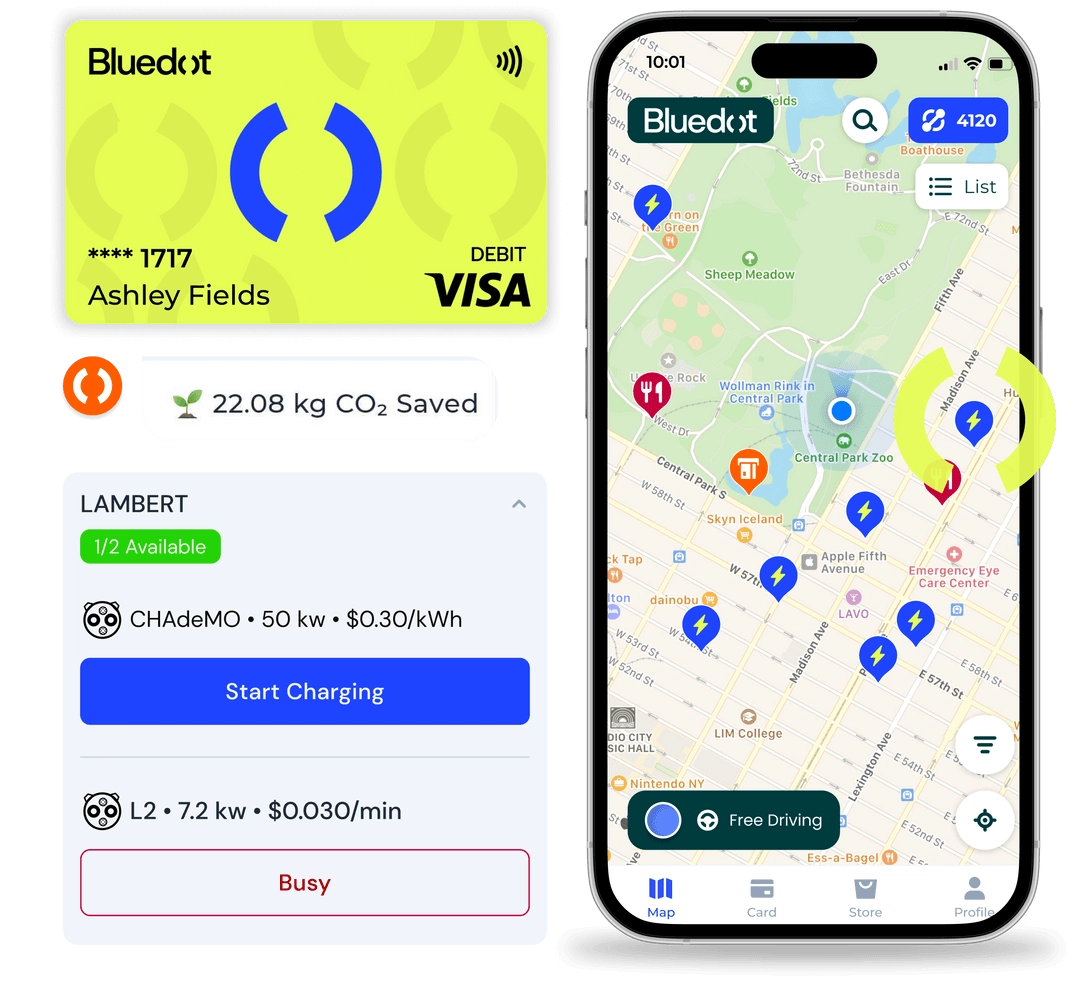

At the heart of their offering is the Bluedot Debit Card, which serves as a one-stop payment method for all automotive purchases, with a special focus on EV charging. Cardholders pay a flat fee of $0.30 per kilowatt hour when charging at participating EV charging stations.

[[ SINGLE_CARD * {"id": "7805", "isExpanded": "false", "bestForCategoryId": "48", "bestForText": "EV Rewards", "headerHint" : "REVOLUTIONIZE YOUR EV REWARDS" } ]]

Additionally, cardholders earn:

- 20% cash back on charging network

- 5% cash back on all qualifying automotive purchases including car insurance, car wash, and parking

- 2% cash back on all other purchases

FDIC-Insured Funds through Piermont Bank Partnership

To ensure the security of user funds, Bluedot has partnered with Piermont Bank, a hybrid bank that brings together banking and agile fintechs. Piermont also issues the FutureCard Visa Debit Card and Workmade Debit Card. All funds held in Bluedot deposit accounts are FDIC-insured up to the legal limit of $250,000 per depositor, providing users with peace of mind and protection for their money.

How To Apply for the Bluedot Debit Card

Applying for Bluedot Card is a straightforward process that prioritizes user security and privacy. While users are required to provide their Social Security Number (SSN) as part of the application, this step is solely for identity verification purposes and does not involve a credit check. Bluedot welcomes all EV drivers, regardless of their credit score or history, to join their platform and start saving. To apply, just download the Bluedot mobile app, available on the Apple App Store and Google Play Store.

Other Cards That Earn Rewards for EV Charging

In addition to the Bluedot Debit Card, here are a few notable options if you want to earn rewards for electric charging:

U.S. Bank Altitude® Connect Visa Signature® Card

[[ SINGLE_CARD * {"id": "316", "isExpanded": "false", "bestForCategoryId": "48", "bestForText": "Rewarding of Electric Vehicle Owners", "headerHint" : "REWARDS TO SUIT YOUR LIFESTYLE" } ]]

Bank of America® Customized Cash Rewards Credit Card

[[ SINGLE_CARD * {"id": "188", "isExpanded": "false", "bestForCategoryId": "48", "bestForText": "Customizable Rewards", "headerHint" : "CASH BACK FOR EV CHARGING" } ]]

PenFed Platinum Rewards Visa Signature® Card

[[ SINGLE_CARD * {"id": "1422", "isExpanded": "false", "bestForCategoryId": "48", "bestForText": "Maximizing Your Charging", "headerHint" : "EARN MORE WITH YOUR CAR" } ]]

The Ultimate Solution for EV Owners?

With its generous rewards - especially for a debit card - along with comprehensive financial management tools and commitment to increasing EV adoption, Bluedot is the perfect solution for EV drivers looking to save money and simplify their ownership experience. By downloading the Bluedot app and signing up for the Bluedot Debit Card, users can unlock a world of benefits and join a growing community of like-minded individuals passionate about sustainable transportation.From a logistics perspective, the Bluedot app eliminates the need for multiple charging apps, which allows users to easily locate stations and pay directly for charges with partner charging companies.

Conclusion

Bluedot's mission to revolutionize EV ownership through rewards and innovative financial solutions shows its commitment to a greener future. By making EV adoption more appealing and accessible, Bluedot is not only helping individuals save money but also contributing to the global effort to reduce carbon emissions and combat climate change. If you're an EV owner looking to maximize your savings and simplify your financial management, you should give Bluedot - or these other card offerings - a look!

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)