Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

Cash App Score: The Real-Time Credit Score That Approves 38% More Borrowers (Here's How It Works)

July 1, 2025

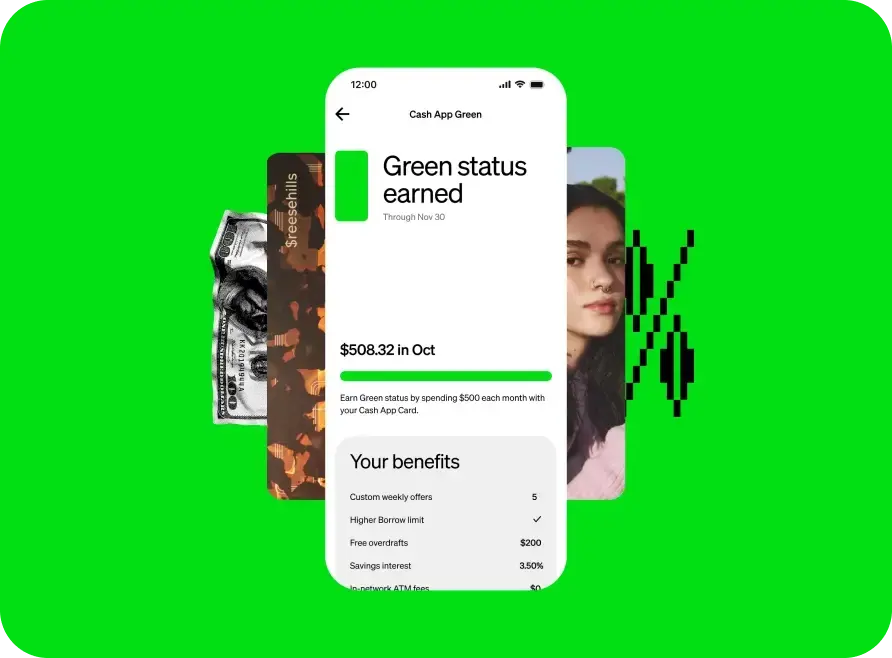

Block's Cash App is rewriting the rules of credit scoring. In November 2025, the fintech giant launched a pilot program that gives select customers visibility into their Cash App Score, a near-real-time measure of financial health that determines access to Cash App Borrow and other credit products.

Unlike traditional credit scores that rely on outdated data and penalize consumers with thin credit files, Cash App Score uses live financial behavior to make lending decisions. Here's everything you need to know about this innovative approach to creditworthiness.

What Is Cash App Score?

Cash App Score is Block's proprietary credit scoring system that analyzes your financial activity within the Cash App ecosystem in near real-time. Instead of waiting weeks for credit bureaus to update your information, this score reflects your current financial health based on actual behavior.

The score considers factors like:

- Paycheck deposits: Regular direct deposits signal stable income

- Spending patterns: How you manage your Cash App balance

- Savings activity: Maintaining funds in your account

- Repayment history: Paying back Cash App Borrow loans on time

- Transaction frequency: Active use of your Cash Card

How Cash App Score Differs from Traditional Credit Scoring

Traditional credit scoring systems like FICO have significant limitations that Cash App Score addresses:

Traditional Credit Scores: Backward-Looking and Exclusive

Traditional credit bureaus rely on static, delayed data that often misrepresents current financial health. These systems:

- Emphasize long credit histories, penalizing younger consumers

- Report information weeks or months after transactions occur

- Lock out nearly 100 million Americans with thin or no credit files

- Create barriers for Gen Z consumers (63% of Gen Z credit card owners have switched to other payment methods due to confusion and anxiety around credit cards)

Cash App Score: Forward-Looking and Inclusive

Cash App Score takes a different approach by:

- Using real-time data: Your score updates dynamically as you take action within the app, with weekly visibility updates

- Measuring current capability: Focuses on what you're doing now, not just your past

- Expanding access: 38% more Cash App Borrow loan approvals compared to traditional credit underwriting at the same loss rate

- Proving predictive power: Over 70% of active Cash App Borrow customers have FICO scores below 580, yet maintain 97% repayment rates

This demonstrates that behavioral data from live financial activity is both more predictive and more inclusive than traditional credit reports.

How Cash App Score Works

The Cash App Score pilot gives select customers access to a dedicated Score tile within their app where they can:

- View their current score: See the number that determines Cash App Borrow eligibility

- Understand influencing factors: Get personalized insights on what drives their score

- Take action: Receive specific recommendations to improve their score

- Track progress: Watch their score adjust in near real-time as they implement positive behaviors

- See potential rewards: Understand what higher scores can unlock (e.g., "raising your score by 20 points may grow your Cash App Borrow limit")

Block used its AI tools to translate complex underwriting model features into customer-friendly concepts and actionable recommendations, making state-of-the-art financial models accessible.

Impact on Your Traditional Credit Score

Here's what Cash App users need to know about how Cash App Score relates to traditional credit:

- No credit check for Borrow: Cash App doesn't perform a credit check when you initially use the Borrow feature

- Timely payments not reported: Making on-time payments doesn't typically get reported to major credit bureaus

- Defaults may impact credit: If you default on a Cash App Borrow loan and it goes to collections, it could negatively affect your traditional credit score

- Separate scoring systems: Cash App Score is an internal metric distinct from FICO or VantageScore

Improving Your Cash App Score

Reddit users and pilot participants report that several actions can boost your Cash App Score:

- Set up direct deposit: This significantly increases limits for many users

- Maintain consistent cash flow: Regular money movement through your account matters

- Pay loans on time: Consistently repaying Cash App Borrow loans early or on time is crucial

- Use your Cash Card: Frequent Cash Card usage contributes to a higher score

- Keep funds in your balance: Maintaining savings in your Cash App account demonstrates financial stability

The Broader Context: Block's Integrated Credit Ecosystem

Cash App Score is part of Block's larger strategy to provide accessible financial services across its ecosystem:

- Cash App Borrow: Short-term loans up to $500 with no traditional credit check

- Afterpay: Buy now, pay later services are integrated across the platform

- Square Loans: Business lending for Square merchants

- Upcoming Afterpay on Cash App Card: A pilot launching within months will let eligible cardholders turn any purchase into a pay-over-time transaction anywhere Visa is accepted

[[ SINGLE_CARD * {"id": "447", "isExpanded": "false", "bestForCategoryId": "15", "bestForText": "Credit Builders", "headerHint": "No Credit Impact"} ]]

Together, Block has provided access to nearly $200 billion in credit globally while maintaining low loss rates, proving that expanding access and managing risk aren't mutually exclusive.

When Will Cash App Score Be Widely Available?

The Cash App Score pilot is currently available to select customers. Block expects to begin a broader rollout in 2026.

How to Check Your Credit Score for Free with Kudos

While Cash App Score provides valuable insights into your Cash App ecosystem creditworthiness, it's also important to monitor your traditional credit score. That's where Kudos comes in.

Kudos offers free credit score monitoring alongside its powerful credit card optimization tools. Here's what you get:

- Free credit score access: Check your VantageScore® 3.0 score anytime

- Credit monitoring: Track changes and get alerts about your credit report

- Smart card recommendations: Get personalized suggestions for cards that match your credit profile

- Approval odds: See your likelihood of approval before applying

- No impact on your score: Checking your score through Kudos won't hurt your credit

Unlike Cash App Score, which focuses on your Cash App activity, Kudos gives you visibility into your traditional credit score that lenders across the industry use. Completely free.

The Bottom Line

Cash App Score represents a fundamental shift in how credit scoring can work. By measuring current financial capability rather than past credit history, Block is creating a more inclusive and transparent system that helps millions of Americans access credit who might otherwise be locked out.

For consumers, this means:

- Greater transparency into credit decisions

- Actionable insights to improve creditworthiness

- Faster access to credit based on real-time behavior

- An alternative path for those with thin credit files

As the pilot expands in 2026, Cash App Score could reshape how we think about creditworthiness in the digital age. And while you're building your Cash App Score, don't forget to monitor your traditional credit score for free with tools like Kudos to get a complete picture of your financial health.

Want to maximize your credit card rewards while building credit? Download Kudos to get free credit score monitoring, personalized card recommendations, and automatic rewards optimization at over 15,000 stores.

Optimize your rewards, and make smarter card decisions along the way.

The credit game has new rules. Make sure you're playing with the right tools.

Ready to build credit and maximize rewards? Get Kudos free and start tracking your credit score, discovering cards you'll actually get approved for, and earning more from every purchase.

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)