Kudos has partnered with CardRatings and Red Ventures for our coverage of credit card products. Kudos, CardRatings, and Red Ventures may receive a commission from card issuers. Kudos may receive commission from card issuers. Some of the card offers that appear on Kudos are from advertisers and may impact how and where card products appear on the site. Kudos tries to include as many card companies and offers as we are aware of, including offers from issuers that don't pay us, but we may not cover all card companies or all available card offers. You don't have to use our links, but we're grateful when you do!

What is the CardMatch Tool? Your Guide to Pre-Qualified Credit Card Offers

July 1, 2025

What is CardMatch and How Does it Work?

Are you tired of missing out on the best credit card deals? Say hello to CardMatch, your secret weapon for scoring exclusive credit card offers. But what exactly is this tool, and how does it work its magic?

CardMatch is a powerful online tool that connects you with personalized credit card offers from various credit card issuers. It's like having a VIP pass to the world of elite credit cards.

Here's a simple breakdown of how it works:

- You provide some basic information (don't worry, we'll talk about safety soon).

- CardMatch performs a soft inquiry on your credit report.

- Based on this soft pull, it shows you targeted credit card offers that you're more likely to qualify for.

It's that straightforward. No complicated processes, just an easy way to see what's out there for you.

Is CardMatch Safe? Debunking the Myths

Now, let's address the elephant in the room. "Is this CardMatch thing actually safe?" It's a fair question, and we've got the answers.

Is The Points Guy CardMatch Safe?

Yes, The Points Guy (TPG) CardMatch tool is safe to use. TPG is a big name in the credit card and travel rewards space. They team up with CardMatch to offer this service, and they take your privacy seriously. You can trust that your information is in good hands when using TPG's CardMatch.

Is Card Match Safe to Use in General?

Absolutely. CardMatch uses bank-level encryption to protect your personal information. Plus, it only does a soft inquiry on your credit report. That means it won't hurt your credit score. No hard inquiries here, folks.

The Safety Rundown:

- Encryption: Your data is locked down tight with top-notch security.

- Soft inquiry only: Your credit score stays safe and sound.

- Reputable partners: CardMatch works with well-known credit card issuers.

- No obligation: You don't have to apply for any offers you see.

When evaluating CardMatch offers, don't just focus on the signup bonus. Consider factors like the annual fee, bonus categories, and other perks to find the card that best aligns with your spending habits and goals.

Is CardMatch a Preapproval?

Here's where things get a bit tricky. People often mix up CardMatch offers with preapprovals, but they're not exactly the same. Let's break it down:

- CardMatch offers: These are targeted offers based on a soft pull of your credit. They suggest you have a good shot at approval, but it's not a sure thing.

- Preapproval: This is a stronger hint from a specific issuer that you're likely to be approved, often based on more detailed info.

The Benefits of Using CardMatch

Now that we've covered the basics, let's talk about why CardMatch should be your go-to tool for finding new credit cards.

Access to Exclusive Credit Card Offers

CardMatch sometimes serves up credit card offers that you won't find anywhere else. We're talking about bigger welcome bonuses that can make your points-loving heart skip a beat. Imagine snagging The Platinum Card® from American Express or American Express® Gold Card with a bonus that's way above the usual offer. It happens with CardMatch!

Higher Approval Odds

Since the offers are tailored based on your credit profile, you're more likely to be approved for the cards you see. It's like having a credit card matchmaker working just for you. This means less time wasted on credit card applications that might not pan out.

No Impact on Your Credit Score

I can't stress this enough – using CardMatch won't ding your credit score. It's a risk-free way to window shop for your next rewards credit card or cash back card. You can check as often as you like without worrying about hard inquiries piling up on your credit report.

Time-Saver

Instead of applying for cards left and right and hoping for the best, CardMatch helps you focus on offers you're more likely to qualify for. It's efficient, and let's face it, we could all use more time in our day. Plus, it saves you from the disappointment of being denied for a card you really wanted.

How to Make the Most of CardMatch

Ready to dive in? Here are some pro tips to maximize your CardMatch experience:

- Check regularly: Offers change frequently, so make it a habit to check every few months.

- Look for elevated bonuses: Sometimes, CardMatch will show you higher welcome offers than what's publicly available. This is especially true for cards like the Amex Platinum and American Express Gold.

- Compare with public offers: Always cross-reference with what's available on the issuer's website to ensure you're getting the best deal.

- Don't ignore lesser-known cards: Sometimes, the best gem is the one you've never heard of before. You might find a great cash back card or a rewards credit card that perfectly fits your spending habits.

- Consider the annual fee: While big bonuses are exciting, make sure the card's benefits justify any annual fee in the long run.

CardMatch and Popular Credit Cards

Let's talk about some of the heavy hitters you might find on CardMatch.

American Express® Gold Card

Another popular option, the American Express® Gold Card, often shows up with enticing offers on CardMatch. If you're a foodie who loves to travel, keep an eye out for this one. With its robust rewards on dining and groceries, plus some nice travel perks, it's a card that can quickly become a favorite in your wallet. Terms Apply.

[[ SINGLE_CARD * {"id": "118", "isExpanded": "false", "bestForCategoryId": "3", "bestForText": "Dining", "headerHint" : "REWARDS FOR DINING" } ]]

Cash Back and Rewards Credit Cards

It's not all about premium travel cards. CardMatch also features excellent cash back and rewards credit cards. Whether you're looking for a flat-rate cash back card or a card with rotating bonus categories, you might find your perfect match here. From the Citi Double Cash Card to various Capital One offerings, there's something for everyone.

CardMatch vs. Other Pre-Qualification Tools

While CardMatch is great, it's not the only pre-qualification tool out there. Many credit card issuers offer their own pre-qualify or pre-approve credit options. These can be useful if you're interested in a specific issuer's cards. However, CardMatch has the advantage of showing offers from multiple issuers in one place, saving you time and effort.

Understanding the Impact on Your Credit

One of the best things about CardMatch is that it uses a soft inquiry to check your credit report. This is different from a hard inquiry, which happens when you actually apply for a credit card.

Here's why this matters:

- Soft inquiry: Doesn't affect your credit score. This is what CardMatch uses.

- Hard inquiry: Can slightly lower your credit score for a short time. This happens when you apply for a card.

So, you can use CardMatch as much as you want without worrying about your credit score. It's a great way to see what's out there without any risk.

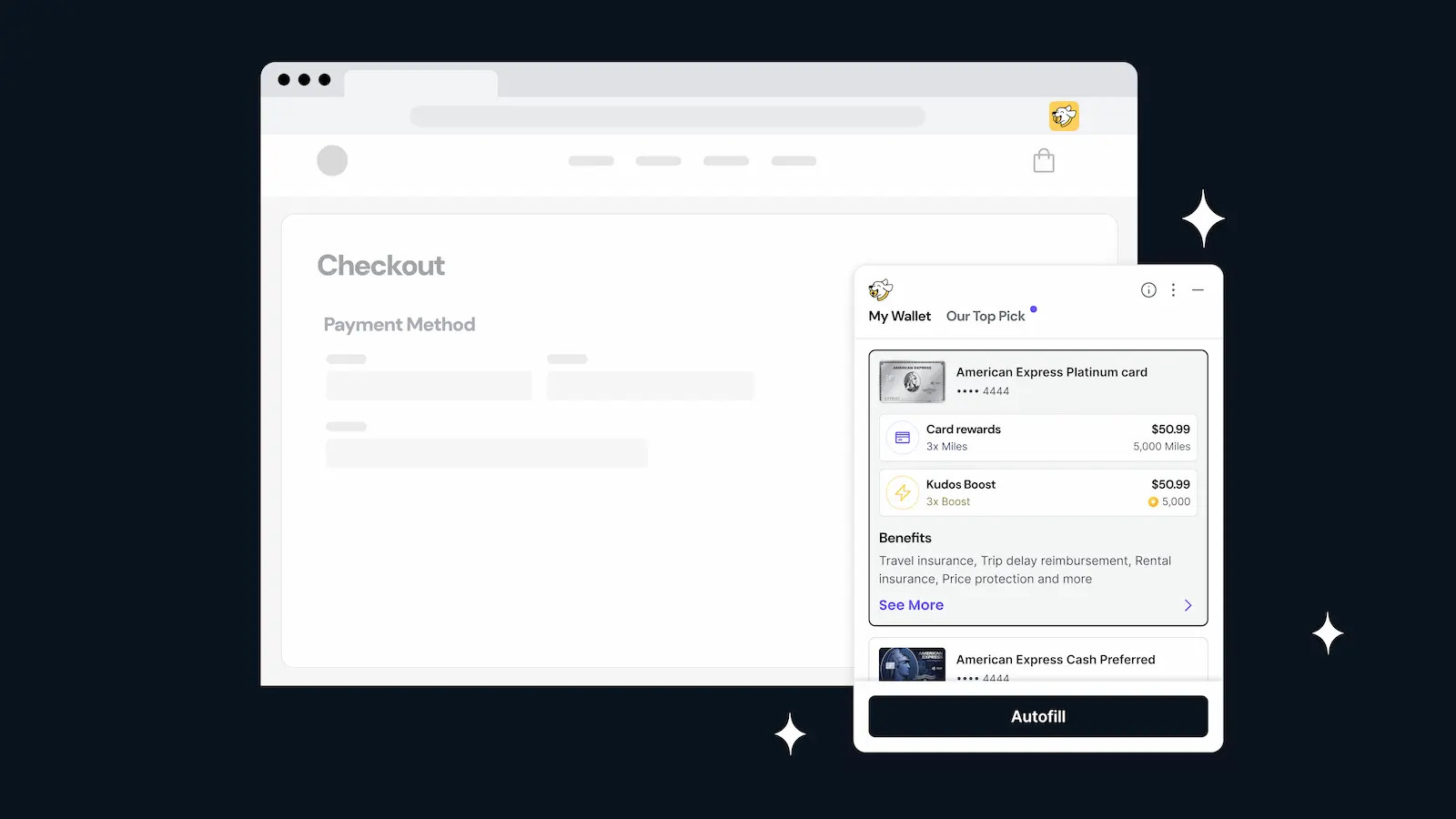

Kudos: The Smart Way to Optimize Your Credit Card Rewards

While CardMatch is an excellent tool for finding great credit card offers, there's another player in town that's taking credit card optimization to the next level: Kudos. Let's dive into what Kudos is and why it's a game-changer for anyone serious about maximizing their credit card rewards.

What is Kudos?

Kudos is a free, AI-powered smart wallet that helps you make the most of your credit cards. It's like having a personal credit card expert in your pocket, guiding you to maximize rewards with every purchase. Kudos goes beyond just helping you find new cards – it helps you optimize the cards you already have.

Why Kudos is Great for Reward Seekers

- Automatic Optimization: Kudos recommends which card to use for each purchase, ensuring you always earn the most rewards possible.

- Comprehensive Card Coverage: Unlike many sites that only review cards with affiliate links, Kudos analyzes nearly 3,000 credit cards. This means you get unbiased, data-driven recommendations.

- Seamless Integration: Kudos works like a super-charged version of Apple Pay, making it easy to use the right card at the right time.

- Exclusive Offers: Through partnerships with CardMatch and The Points Guy, Kudos users get access to some of the best credit card offers available.

Kudos + CardMatch + The Points Guy: A Powerful Combination

Kudos has partnered with CardMatch and The Points Guy to create a credit card rewards powerhouse. Here's how this partnership benefits you:

- Best-in-Class Offers: Through these partnerships, Kudos can show you exclusive, elevated welcome bonuses that you might not find elsewhere.

- Trusted Recommendations: The Points Guy is known for its in-depth credit card reviews. By partnering with TPG, Kudos ensures its recommendations are backed by expert analysis.

- Streamlined Experience: Instead of juggling multiple sites and tools, Kudos brings everything together in one place. Find great offers through CardMatch, get expert insights from The Points Guy, and manage your cards all within the Kudos app.

Save Time, Earn More

One of the best things about Kudos is how it saves you time. Instead of spending hours researching credit cards, comparing welcome offers, and trying to remember which card to use where, Kudos does the heavy lifting for you. Just use the Kudos app, and you're always making the optimal choice.

Whether you're a points and miles enthusiast or just someone who wants to make sure they're getting the most out of their credit cards, Kudos is a tool worth checking out. It brings together the best of CardMatch's offer-finding ability, The Points Guy's expert knowledge, and adds its own layer of AI-powered optimization.

By using Kudos in conjunction with CardMatch, you're not just finding great new card offers – you're ensuring that you're maximizing the value of every card in your wallet. It's a powerful combination that can take your credit card rewards game to the next level.

The Verdict: Is CardMatch Worth Your Time?

In my opinion? Absolutely. CardMatch is a valuable tool in any credit card enthusiast's arsenal. It's safe, it's free, and it could potentially land you a better offer than you'd find elsewhere.

Sure, it's not a guarantee of approval, and you might not always see mind-blowing offers. But the potential upside far outweighs the minimal effort required to use it.

So, my advice? Give it a shot. Check CardMatch before you apply for your next credit card. You might just stumble upon an offer that makes your rewards-loving heart sing. And if not? Well, you've lost nothing but gained the peace of mind that you didn't miss out on anything spectacular.

Remember, in the world of credit cards, knowledge is power. And CardMatch? It's like your secret weapon in the quest for the perfect card. Use it wisely, and may the rewards be ever in your favor!

CardMatch FAQ

How often should I check CardMatch?

It's a good idea to check CardMatch every few months, as offers can change frequently. Some cardmembers even check monthly to catch any limited-time deals.

Can I use CardMatch if I have a low credit score?

Yes, you can use CardMatch regardless of your credit score. However, the offers you see may vary based on your credit profile. If you have a lower score, you might see more secured credit card options.

Are there any fees to use CardMatch?

No, CardMatch is completely free to use. There's no cost to check your offers.

Will I see offers from all credit card issuers on CardMatch?

While CardMatch partners with many major issuers, it doesn't include every single one. You might not see offers from smaller banks or credit unions.

Can I use CardMatch for balance transfer offers?

Yes, you might see balance transfer offers on CardMatch. However, keep in mind that any balance transfer fees aren't usually shown until you click through to the actual application.

Remember, CardMatch is a powerful tool, but it's just one part of your credit card strategy. Always consider your financial goals, spending habits, and current credit situation when choosing a new card. Happy card hunting!

Unlock your extra benefits when you become a Kudos member

Turn your online shopping into even more rewards

Join over 400,000 members simplifying their finances

Editorial Disclosure: Opinions expressed here are those of Kudos alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

.webp)

.webp)